Scholarships & Aid

FINANCING YOUR FUTURE

A high-quality Christian education from Regent is affordable and a wise investment. Our financial aid team works closely with you to design an aid package that best fits your situation, including federal, state, private and school-funded scholarships to help pay for college. Your dream of a college education can be within your reach — let us help you navigate student financial aid.

Below are some ways we are helping to make college more affordable. Explore these federal, state, private and institutional aid opportunities:

Regent offers a number of scholarships through the College of Arts & Sciences. We encourage you to apply for these scholarships, where applicable.

Scholarships & Grants

Incoming Transfer Students Transfer merit scholarships are based on a student’s cumulative GPA at the time of admission. The cumulative GPA includes academic information from all of a student’s prior coursework at all institutions they attended. Academic information will be formatted into a 4.0 scale.

| Scholarship Name | Award Amount | Eligibility Range (cumulative GPA) |

|---|---|---|

| Chancellors Transfer Scholarship | $7,000 | 3.75 – 4.0 |

| Trustees Transfer Scholarship | $6,000 | 3.5 – 3.74 |

| Presidents Transfer Scholarship | $5,000 | 3.0 – 3.49 |

| Achievement Transfer Scholarship | $2,500 | 2.50 – 2.99 |

Updated test scores or GPAs received prior to July 1st can be used to re-evaluate a student’s merit award on a case-by-case basis initiated by an appeal submitted by the student.

About

Regent University is excited to offer the Church Matching Grant Program (Church Match). Regent’s mission is to equip Christian leaders to change the world. We believe that one way to fulfill that mission is to partner with churches and ministries, both local and abroad.

Amount

Regent University matches your church or ministry’s contribution to your education, dollar-for-dollar, up to $750 per semester. For fall and spring enrollment, this means you may be eligible to receive $1,500 from Regent University in conjunction with your church or ministry’s gift!

How to Apply

A paper application must be completed and signed by your church’s or ministry’s pastor or designated leader. Once signed and completed, the application must be submitted to the university with a check from the church or ministry. Personal checks and Electronic Fund Transfers (EFTs) are not accepted.

For timely processing of this award, please have the application and associated checks submitted according to the following dates:

Fall: August 1

Spring: December 1

Summer: April 1

Grant Renewal

This grant does not automatically renew. A new application must be submitted to receive matching funds.

About

Regent is offering a $4,000 Homeschool Scholarship to all new on-campus, college students who graduate from homeschool.

Amount

Students will receive $1,000 toward tuition annually for 4 years at Regent University.

How to Apply

- Apply to Regent University.

- Submit your official homeschool transcript to regent.edu/items.

Scholarship Renewal

This scholarship will automatically renew each academic year if the minimum cumulative 2.0 GPA requirement is met, and the student has maintained an on-campus enrollment status.

This scholarship will not renew after the student has received the scholarship for 4 years.

About

Regent University is offering a $4,000 scholarship to all new on-campus college students who graduate from a private high school.

Amount

Students will receive $1,000 toward tuition annually for 4 years at Regent University.

How to Apply

- Apply to Regent University.

- Submit your official transcript to regent.edu/items.

Scholarship Renewal

This scholarship will automatically renew each academic year if the minimum cumulative 2.0 GPA requirement is met, and the student has maintained an on-campus enrollment status.

This scholarship will not renew after the student has received the scholarship for 4 years.

About

Regent University is honored to welcome you into our family. When a grandparent, parent, or sibling of a student has graduated from Regent, the student becomes a Legacy student. We are proud to offer our Legacy students additional aid to assist in the achievement of their goals.

An eligible student must be:

- The grandchild, child, or sibling of a CBN or Regent University alumnus

- Individuals are considered alumni if they have graduated and received a degree from CBN or Regent University

Amount

An eligible student will receive an award of $500 annually, split between fall and spring semesters.

How to Apply

Alumni affiliation is reviewed automatically using information gathered during the admissions process. Follow-up instructions will be sent to complete verification of the student’s eligibility.

Grant Renewal

This scholarship will automatically renew each academic year if the minimum cumulative 2.0 GPA requirement is met, and the student has maintained an on-campus enrollment status.

About

As a military-friendly school, Regent University recognizes that families are the “heroes at home” who love and support our service men and women defending our precious freedom. We are pleased to award a tuition discount to the children of active-duty military service members, reservists, or honorably discharged veterans and retirees to honor their sacrifices.

Amount

Dependent children of may be eligible for a $1,000 grant annually.

How to Apply

Military affiliation is reviewed automatically using information gathered during the admissions process. Follow-up instructions will be sent to complete verification of the student’s eligibility.

Grant Renewal

This scholarship will automatically renew each academic year if the student has maintained an on-campus enrollment status.

About

At Regent University, our students are cherished, and we recognize that financial need is a big factor regarding education. This grant is designed to cover gaps between financial aid availability and pre-determined estimates of individual financial need. Financial need is determined using a combination of Free Application for Federal Student Aid (FAFSA) information and University-set parameters. This grant is separate from the Federal PELL Grant and many students who may be ineligible for the PELL Grant are eligible for Regent Gap Guarantee Grant.

Amount

Award amounts will vary depending on University-determined financial need.

How to Apply

Grant eligibility is determined automatically using information gathered during the completion of the FAFSA. A separate application for Regent Gap Guarantee Grant consideration is not required. Please note that eligibility cannot be determine until the FAFSA is received and accompanying Financial Aid requirements are completed (I.e., verification, conflicting information, etc.).

If you receive a scholarship, grant, book voucher or additional form of gift aid funded by Regent University your Regent Gap Guarantee Grant award will be reduced by the amount of your new Regent University funded award. If you receive gift aid from a source other than Regent University your existing Regent Gap Guarantee Grant award will only be reduced as mandated by the terms & conditions of the new award. Standard award stipulations commonly include limitations on what the funds can be used to cover (tuition only, or up to the students cost of attendance).

Grant Renewal

This scholarship will automatically renew each academic year if the minimum cumulative 2.0 GPA requirement is met, and the student has maintained an on-campus enrollment status.

About

Regent is one of the leading military and veteran-friendly colleges in the country. We are dedicated to assisting our ROTC students with pursuing their dreams by offering an extensive tuition discount.

An eligible student will be one of the following:

- College Program Army and Navy ROTC students

- Cross-registered each semester for a military science course at ODU and participating in all ROTC activities as defined by the ODU Cadre

Amount

An eligible student will receive a reduced tuition rate of $250 per credit hour.

How to Apply

Visit the ROTC website to learn more about the application process.

Discount Renewal

This scholarship will automatically renew each academic year if the student has maintained membership within the ODU ROTC program.

About

Regent University has partnered with Phi Theta Kappa (PTK) to offer inducted members a specialized scholarship to assist them in reaching their academic goals.

An eligible student will:

- Be inducted into PTK before the first day of classes during their entry term.

- Have a minimum cumulative 3.0 GPA requirement determined at the time of CAS admission. GPAs will be calculated from a thorough review of all prior college work.

Amount

An eligible student may receive an award up to $1,000 annually, split between fall and spring semesters.

How to Apply

To apply email one of the following items to faforms@regent.edu or fax it to 757.352.4118:

- Copy of membership ID card

- Copy of membership certificate

- Copy of induction email

NOTE: If transcripts submitted for admissions list Phi Theta Kappa membership, the aforementioned documents will not be required.

Scholarship Renewal

This scholarship will automatically renew each academic year if the minimum cumulative 3.0 GPA requirement is met, and the student has maintained an on-campus enrollment status.

- An eligible student will receive an award of $500 annually split between fall and spring semesters.

- An eligible student will be a graduate with an A.A., A.S., or A.A.S. of a Virginia Community College.

- An eligible Virginia Community College is one that is part of the Virginia Community College System.

- Award renewals require the maintenance of good academic standing as noted in the Undergraduate Catalog.

- An eligible student may receive an award up to $1,000 annually.

- Student must have earned an A.A., A.S. or AAS degree from a North Carolina Community College that is part of the North Carolina Community College System.

- Award renewals require the maintenance of good academic standing as noted in the Undergraduate Catalog.

Please visit the North Carolina College System for more information.

About

Regent University is proud to offer an extensive tuition discount to eligible National Oceanic and Atmospheric Administration (NOAA) or United States Public Health Service (USPHS) students.

An eligible student will be one of the following:

- A current officer of the NOAA or USPHS.

- A former officer of the NOAA or USPHS.

Amount

An eligible student will receive a reduced tuition rate of $250 per credit hour.

How to Apply

Email one of the following items to faforms@regent.edu or fax it to 757.352.4118

- Copy of their Leave and Earning Statement (LES) or

- Copy of their Statement of Service

Discount Renewal

This scholarship will automatically renew each academic year if the student has maintained an active enrollment status.

About

Regent University is pleased to award two scholarships to National Merit Scholarship Finalists and Semi-finalists in recognition of their achievement.

Amount

National Merit Finalist are eligible to receive a 100% tuition scholarship.

National Merit Semi-finalist are eligible to receive a $10,000 tuition scholarship.

NOTE: These scholarships do not apply to fees or student housing.

How to Apply

Finalists and Semi-finalists should notify their Admissions Counselor during the application process.

Scholarship Renewal

These scholarships will automatically renew each academic year if the minimum cumulative 3.3 GPA requirement for the National Merit Finalist Scholarship and a minimum cumulative 3.0 GPA requirement for the National Merit Semi-finalist Scholarship is met, and the student has maintained an on-campus enrollment status.

About

A generous on-campus undergraduate tuition scholarship is available to the NCFCA Champion in each of the following categories:

- Team Policy (including Speaker)

- Apologetics

- Biblical Presentation

- Biographical Narrative

- Duo Interpretation

- Extemporaneous

- Illustrated Oratory

- Impromptu

- Informative Speaking

- Lincoln Douglas

- Moot Court (including Best Advocate)

- Open Interpretation

- Original Interpretation

- Persuasive Speaking

- Speech Sweepstakes

Amount

An eligible student will receive a 50% tuition scholarship.

How to Apply

Students should notify their Admissions Counselor during the application process.

Scholarship Renewal

This scholarship will automatically renew each academic year if the minimum cumulative 3.5 GPA requirement is met, and the student has maintained an on-campus enrollment status.

Note: Regent University reserves the right to change or alter any scholarship requirements, deadlines or award amounts.

The U.S. Department of Education awards about $150 billion a year in financial aid through grants, student loans and other programs. Some federal aid is gift aid, or grants, that do not need to be paid back; while other aid consists of student loans that must be repaid. To be considered for federal aid, you must complete the FAFSA.

State aid is funded by your state of residence. Regent accepts all state aid, but options for out-of-state students can be limited. Typically, states provide aid to encourage residents to pursue education within their home state, but some out-of-state aid is available.

In-State Students

Virginia Community College Transfer Grant

Virginia Tuition Assistance Grant

Virginia Teaching Scholarship Loan Program

Out-of-State Students

Find contacts for your state to learn about financial aid for out-of-state students.

Private aid is aid funded by an external organization. This aid can be in the form of scholarships, loans or grants to help pay for college.

Private grants and scholarships are typically considered as gift aid that you will not be required to repay. Many grants and scholarships can be combined, so apply for as many as you can. There are thousands of options available, but some will have very specific eligibility criteria.

Explore private scholarships

Discover private scholarship search engines

Private loans are based on your credit history and must be repaid. Students are encouraged to avoid taking out private loans if possible because these loans usually have higher interest rates and are not eligible for federal repayment plan options.

Learn more about private loans

Comprehensive Private Loan Lender List

HOW TO APPLY FOR FINANCIAL AID & SCHOLARSHIPS

Reaching your educational and career goals while maximizing your financial aid starts here. By completing the steps to apply for financial aid outlined here, you can help make earning your degree more affordable.

Financial aid checklist

Follow The Steps To Apply For Financial Aid:

STEP 1: Complete the FAFSA

- Complete the FAFSA online and enter Regent's school code: 030913

- 4-7 business days later, Regent Financial Aid Office will receive a copy

- Next, we will send your User ID and PIN by email

It is recommended you complete the FAFSA at least 6 months prior to the start of class.

STEP 2: Fulfill Financial Aid Requirements

- Access your Financial Aid Application by logging into your account. Our easy-to-follow steps are here.

- The Financial Aid Office will process your documents within 3-5 business days.

Federal student loan borrowers must complete the Entrance Counseling and Master Promissory Note (MPN). Have you completed them yet?

STEP 3: Review & Accept Your Awards

Payment Options:

- Federal Aid

- Institutional Aid

- State Grants

- Privately Funded

- Tuition Installment Plan

- Military Benefits

Follow the steps on accepting your awards offers here.

STEP 4: Complete Semester Check-In

Log in to MyRegent Portal and click on the Semester Check-in banner on your homepage.

- Confirm final course schedule

- View any bookstore credits

- Review final account balance or refund

- Finalize payment arrangement

Financial Aid refunds are disbursed 17 days after the first day of class.

Completing the Free Application for Federal Student Aid (FAFSA) is the most important step for many students as they create their financial readiness plan. The FAFSA reviews household income, available assets, and overall household size to create a need assessment that is unique to you. This is sent to your school of choice and used to determine eligibility for multiple types of aid. The FAFSA can be completed in three easy steps and generally takes most people less than one hour.

- Create a FAFSA Login (FSA ID)

- Collect the documents you will need

- Complete the application at fafsa.gov

Your FAFSA results will be sent to Regent as long as you provide our school code (030913). The Department of Education provides more information regarding the FAFSA here.

Priority Deadline: Regent University does not impose a FAFSA priority deadline, however we do recommend that students who wish to pursue federal aid submit their FAFSA at least two months prior to the payment deadline. It is normal for some FASFA applications to require additional student paperwork with the institution and early submission allows the student time to understand, collect, and submit any follow up document items needed. Students will receive an email once their FAFSA is received to guide them to their next steps in the application process.

Contact Information:

Admissions - Phone: 757.352.4127 | Email: admissions@regent.edu

Advising & Financial Aid - Phone: 757.352.4385 | Email: advising@regent.edu | finaid@regent.edu

FAFSA AID – FREE APPLICATION FOR FEDERAL STUDENT AID

Submitting the FAFSA on the web is the fastest way to apply for federal student aid. You will get your result 7 to 14 days faster than if you mail in a paper application. This page has been designed to help you in understanding FAFSA and submitting the FAFSA on the web. Please read the tips before you submit the FAFSA on the web. Regent University’s FAFSA school code is 030913.

All students filing out a FAFSA on the web need to first request an FSA ID. The FSA ID is the identifier to let you access personal information in various U.S. Department of Education systems. The FSA ID is required to submit the online Renewal FAFSA or to make online corrections to your FAFSA.

- Your Social Security card and driver’s license

- Your income tax return

- Your W-2 forms

- Untaxed Income Records (i.e.: Social Security Temporary Assistance for Needy Families, veteran’s benefits)

- Current bank statements, records of stocks, bonds and other investments

- Business or farm records (if applicable)

- Your alien registration card (if you are not a U.S. citizen) You will need income records for the year prior to when you start school.

- FAFSA Information 2018 – 19 (Academic Year August 2018 – July 2019) Provide tax data from the 2016 tax year.

- FAFSA Information 2019 – 20 (Academic Year August 2019 – July 2020) Provide tax data from the 2017 tax year.

- Save Your FAFSA: Save your application frequently using the “Save” button at the bottom of the screen. That way, if you lose your Internet connection, you’ll have a copy of the FAFSA data you’ve already entered.

- Get Help: To get an index of help topics, click on the Help button. For more information call 1.800.4.FED.AID.

- Don’t Erase Your Form: Use the “Exit” button with caution. Selecting this button and answering “OK” to the prompt that appears will erase every answer on your FAFSA.

- Print Help Topics: To print the text for a help topic or a Frequently Asked Question, open the help window then:

- For Windows users, press the Ctrl and P keys at the same time.

- For Mac users, press the command and P keys at the same time.

- Sign Your Application: If you print the signature page, you need to sign it and mail it. If you have stated that you want to electronically sign your application you need to obtain a PIN.

- Submit Your Application: Be sure to click the “Submit” button. You will be taken to a new web page that confirms your submission and gives you a confirmation number.

Q: Does it matter if I type my answers in upper-or lowercase letter?

A: No. All letters will be converted to uppercase when you submit your FAFSA.

Q: Should I leave financial questions blank, enter 0 (zero) or N/A?

A: If a financial question doesn’t apply to you, you can either leave it blank or enter 0 (zero). Do not type N/A into the answer field.

Q: If my answer to a financial question includes cents, do I round off to the nearest dollar, or do I include cents in my answer? What about commas?

A: No. Do not enter a decimal point or cents. Instead, round off your answer to the nearest dollar and type in this amount. Do not enter commas.

- With the exception of the federal Pell Grant, third-party sources authorizing such, and certain university stipend programs, no combination of scholarships and grants may exceed 100 percent of tuition. University-funded financial aid is only applicable to tuition charges for courses taken at Regent University. University-funded financial aid is not applicable to study abroad programs.

- Tuition is due and payable in full by the published deadline regardless of any pending financial aid (loans or grants). A Tuition Installment Plan (TIP) is available for a nominal fee. Contact the Business Office for more information. Failure to make payment by the established deadline will result in a late fee.

- To receive school-based awards, students must meet the eligibility criteria set out in the awarding school’s financial aid guide. If you need a copy of these guidelines, please contact your school(s) of enrollment.

- Many schools at Regent require annual resubmission of financial aid applications. Contact your individual school for more information.

- Any person who knowingly makes a false statement or a misrepresentation in his or her request for financial aid shall be subject to the provisions of Regent student discipline policies, the United States Code and/or the Code of the Commonwealth of Virginia, whichever is applicable.

- Federal student loans, Pell Grant and Virginia Tuition Assistance Grant Funds (VTAG) are conditional upon regulations/legislation in effect at the time of disbursement.

- All financial aid is to be used solely for expenses related to attendance at Regent University. Institutional scholarships will not be applied to charges related to non-Regent study abroad programs.

- Financial aid recipients who withdraw during a term, or reduce their academic load below the required minimum hours for the aid received, are subject to the provisions of the university refund policy and “Return of Title IV Funds Aid Policy” available from the Business Office. You must notify Student Financial Aid if you are enrolled, were enrolled or will be enrolled at another institution during the same award year as you are in attendance at Regent and you receive, or will receive, the Federal Pell Grant or Federal Stafford Loan (or Federal Direct Stafford Loan).

- You must be enrolled at least half-time as a regularly enrolled student in a degree-seeking program to be eligible for loans, Federal Pell Grants and most other aid available. Based on the policy defined by the University Academic Council, five hours are considered half-time for the fall and spring semesters for graduate students, three hours for doctoral students and six for undergraduate students. For the summer, three credits are considered half-time for graduate students. There are few exceptions to this definition (i.e., Ph.D. dissertation, etc.). Undergraduate students must enroll for at least six credit hours each semester (including the summer) to be considered a half-time student. Contact the Office of Advising for more information.

- If you receive additional aid (scholarships/grants) or other outside resources, your awards must be modified. Notify the Student Financial Aid of any additional resources not previously included that are available from other resources such as loans, scholarships, grants, Social Security benefits, veterans’ benefits, employer tuition payment plans and other educational assistance. Failure to do so before the first financial aid disbursement will result in a potentially significant lower subsequent disbursement. In some cases it may result in having to repay a portion of the aid received.

- Any student who receives financial aid funds, but does not attend any of the classes (or complete any distance coursework) for which the disbursement was made, is required to have the entire amount returned to the funding entity immediately. This is done by returning the payment received to Regent. Regent will, in turn, refund it to the funding entity on the student’s behalf. This may result in a balance due to the university.

- SATISFACTORY ACADEMIC PROGRESS

To qualify for aid processed through the Student Financial Aid Office, a student must be making Satisfactory Academic Progress (SAP) toward the completion of a degree program. If a student fails to meet the standards summarized below, the student will be placed on financial aid warning for the next semester of enrollment. During the financial aid warning semester, the student will be eligible to receive federal aid but must meet the standards by the end of that semester to have continued eligibility. A student will remain ineligible until the standards are met. If a student is declared ineligible, he or she may appeal to the school of enrollment for reinstatement. To be considered making SAP, a student must:- Complete at least 50 percent of all credits attempted

(67 percent for undergraduate) - Cumulative GPA of at least 3.00

(2.00 for law and undergraduate students; 2.50 for M.Div. students) - You must complete your degree within the following time frame:

- Graduate: five years

- Undergraduate: six years

- Doctoral (non-J.D.): seven years

Time is measured as of your first term of enrollment at that level, inclusive of periods of non-attendance. - Learn more about SAP and read the full policy.

- Complete at least 50 percent of all credits attempted

- FEDERAL PELL GRANT

The Federal Pell Grant is available only for those students in the undergraduate program. You must be admitted and enrolled as a regular degree-seeking student to be considered for eligibility. The grant is normally awarded for fall and spring semesters. If a student is not able to utilize the maximum annual Pell Grant amount in fall and spring, then a subsequent award may be made for the summer, if otherwise eligible. The grant is paid typically once per semester, after your attendance is confirmed in the second course (six credit hours) of the term. Your participation/attendance must be confirmed in all courses for which Pell Grant payment is based. If you add or drop courses during the term, your Pell Grant is subject to adjustment. You may not receive the Federal Pell Grant at more than one institution in a term.

- Private loans are not guaranteed; rather, they are based on your credit history. By accepting the loan you are giving permission to the lender to pull your credit history. If the lender determines you are not creditworthy, you will be denied or required to obtain a co-signer. Final notification of approval or denial for private loans is made by your lender.

- Grad PLUS Loans are not guaranteed; rather, they are based on your credit. By accepting the loan you are giving permission for the lender to pull your credit history. If the lender determines you are not creditworthy, you will be denied. Final notification of approval or denial for the Grad PLUS Loan is made by your lender.

- If your parent is applying for a Parent PLUS Loan, the Parent PLUS application must be completed at www.studentaid.gov. Parent Plus Loans are not guaranteed; rather, they are based on your parent’s credit. By accepting the loan and submitting the Parent PLUS application you are giving permission for the lender to pull your parent’s credit history. If the lender determines your parent is not creditworthy, your parent will be denied. Final notification of approval or denial for the Parent PLUS Loan is made by your lender.

- Loan recipients must notify Student Financial Aid in writing of any change in enrollment status, address or family financial circumstance.

- Student Loan Disbursements: student loans are disbursed in at least two equal amounts. Single term loans may be disbursed in one disbursement. Example: a loan for fall/spring will come one half in fall and the other half in spring. A fall only loan will have the entire amount arrive at once.

- Students will not receive any excess loan funds above university charges sooner than the last business day before the start of the term if all requirements are met and loan funds have arrived. Please come prepared to cover initial expenses, including book costs. Educational loans are not intended to cover moving expenses or initial utility deposits.

- Student Loans Disbursed by Paper Check: If your loans are disbursed by paper check, rather than EFT, the check will require your endorsement, as it will be made co-payable to Regent University and the student. The loan check will be available for your endorsement in the Business Office. You will not be eligible for any funds in excess of your tuition charges until you endorse the check and the Business Office produces a refund check for the correct amount.

- Federal and Private Loans: Lenders will send you a NOTICE OF LOAN GUARANTEE AND DISCLOSURE STATEMENT that indicates the amount of the loan that has been guaranteed on your behalf. This notice contains an anticipated disbursement date. This is NOT a definite date of when funds will be available to you. It is the date the lender anticipates wiring funds to Regent (if an EFT lender) or cutting the checks to mail to Regent (if you are using a lender that processes paper checks). Refunds will be issued after the 100% add/drop period, approximately 17 days after the first day of class. Please check our Important Dates Page for more information.

- ALL FIRST-TIME FEDERAL STAFFORD LOAN BORROWERS at Regent are required to complete student loan entrance counseling before any funds may be credited to the student’s account. Entrance counseling may be completed online at www.studentloans.gov. You will be guided through a series of pages containing important information regarding student loans. You are encouraged to complete the entrance counseling requirement at least one week prior to the first day of class to help expedite the refund process. Please allow three to five business days from the time the entrance counseling is completed until the time you may pick up a refund.

- ALL student loan borrowers at Regent are required by federal law and/or Regent University or private lender policy to complete EXIT COUNSELING prior to ceasing enrollment on at least a half-time basis. Graduating students and those who drop to a less than half-time status are required to complete exit counseling. Exit counseling sessions can be completed online at studentaid.gov. Please allow 30 minutes to complete your session.

- Most commonly, loans will be calculated for only the fall and spring semesters. There are a few exceptions to this depending on your program of enrollment. If you are going to be taking classes during the summer term, please inform the Student Financial Aid Office by filling out the Summer Aid Request Form. Forms will be available online after the spring registration period is completed. If you have been awarded the maximum amount of $20,500 in Federal Stafford Loans for the fall and spring terms, and you choose to accept the full amount, you will not have any Stafford Loan eligibility remaining for the summer term. If you choose to attend the summer term, your loan eligibility will be available only through private loans and PLUS loans, which are based solely on your credit history.

- Your loan data will be submitted to the National Student Loan Data System (NSLDS) and will be accessible by guaranty agencies, lenders and institutions determined to be authorized users of the data system.

- Exhaust all other resources before you apply for a loan. Funds to help finance your education may be hidden in people or organizations you would not expect. Contact your employer, your church, family members or do an Internet scholarship search to see what types of aid might be available.

- Remember: Borrow only as much money as you really need.

- Maintain a loan file to keep all information pertaining to your student loans. You are responsible for knowing the name of your lender, their address and how much you borrowed. Law students will be asked this information on bar exam applications.

To qualify for federal financial aid a student must be making satisfactory academic progress (SAP). Federal financial aid includes federal loans, the Pell Grant, and the TEACH Grant.

SAP for financial aid is monitored on two standards:

- Qualitative: Cumulative GPA in your level of study (undergraduate, graduate, doctorate, etc.)

- Quantitative: Successful pace of completion of a minimum of 50 percent of all credits attempted in your academic transcript level in graduate/professional programs, and 67 percent of all credits attempted in the undergraduate level.

Additional Information

Student Loan Disclosure and Code of Conduct

Withdrawals and Return of Title IV Funds Policy

Doctoral Dissertation Students

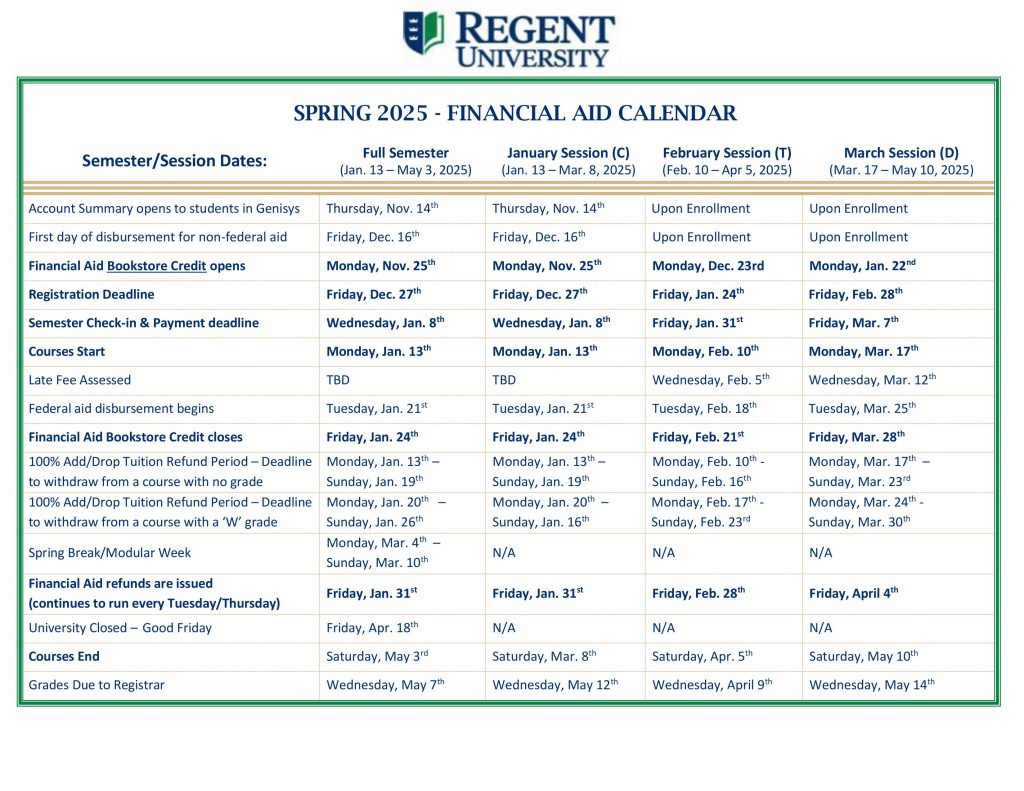

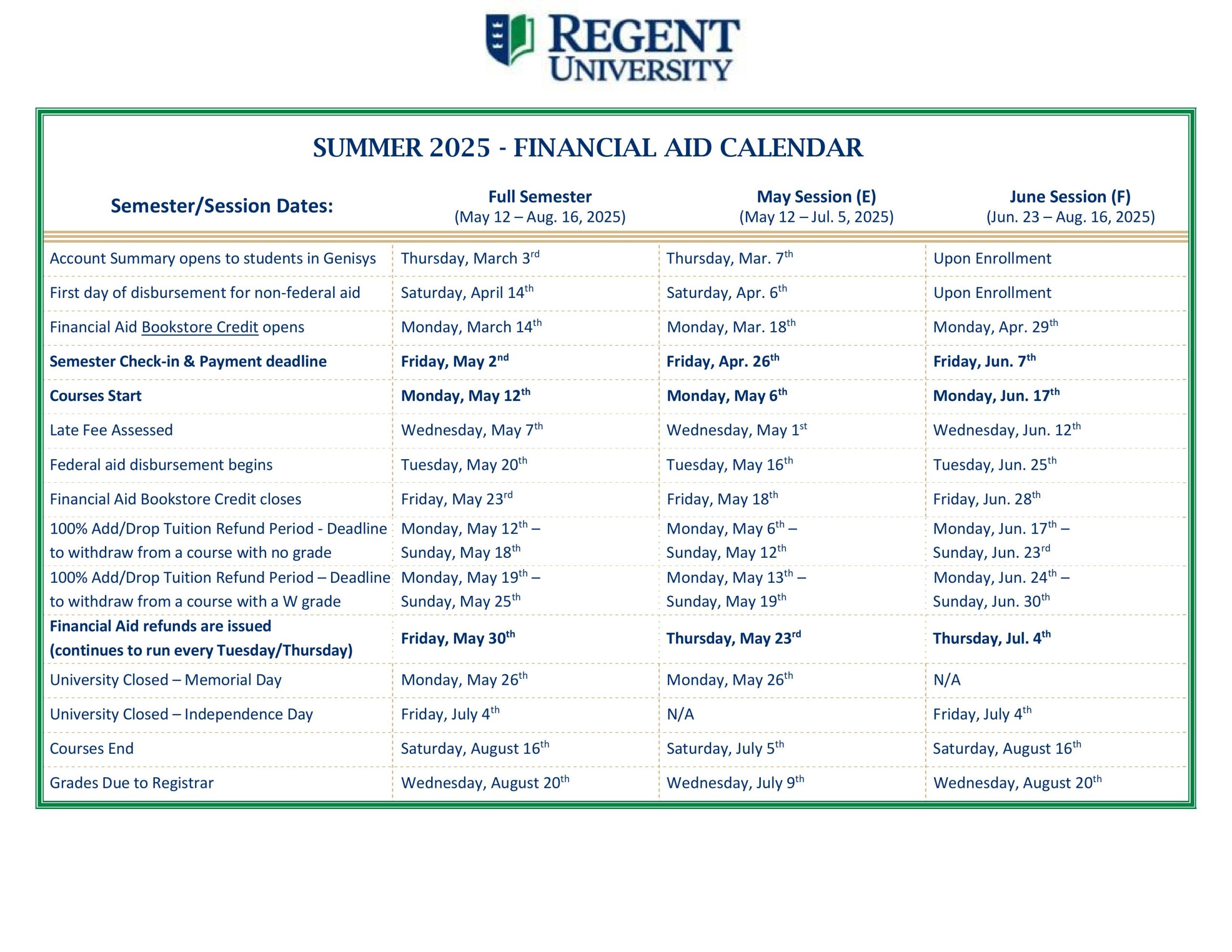

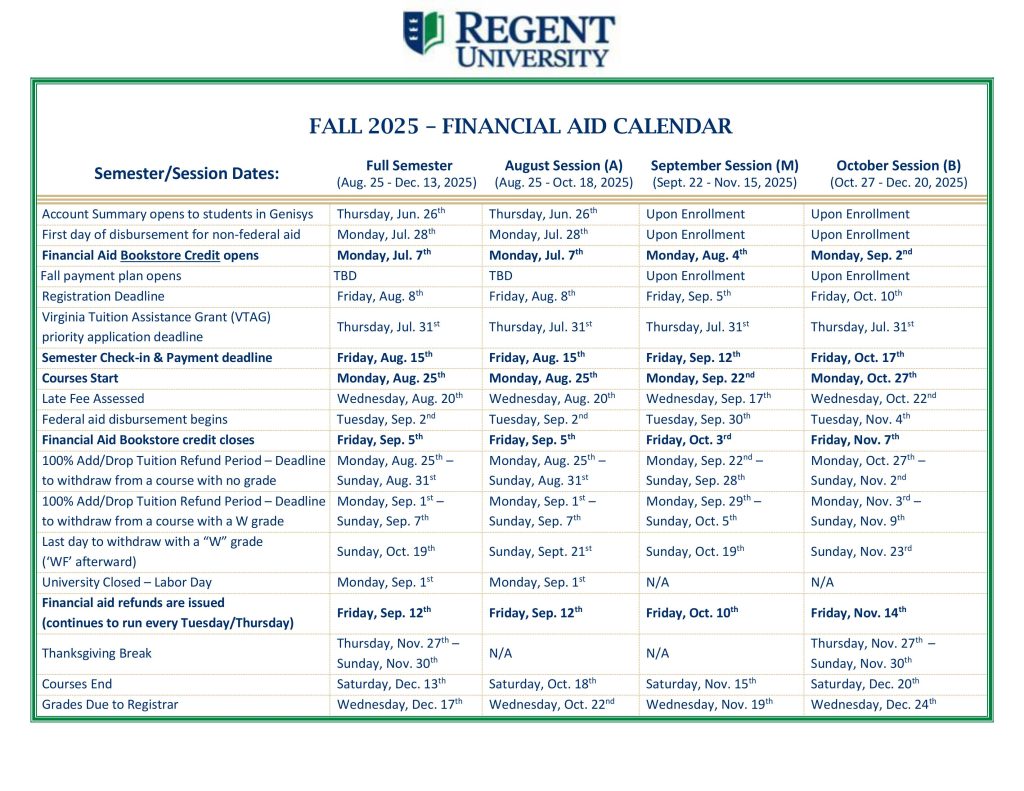

Please select the semester and session start date that is applicable to your enrollment plans.

Attention: Financial aid refunds are issued after the 100% add/drop period, approximately 17 days after the first day of class.